Cross-Selling is an Endurance Run, Not a Sprint

This month, Chase Sapphire signaled a new strategic focus on cross-selling with a lucrative 60,000-point signup bonus for customers opening a new Sapphire Banking premium checking account. In addition, the offer includes special VIP access to Sapphire lounges at concerts, sports and special events as well as early ticket sales and premium seats. The irony is that this offer is coming after Chase spent the summer scaling back and devaluating many of the loyalty offerings for the coveted Chase Sapphire cards, namely the favored Reserved card among millennials. So what gives? We think we have an idea.

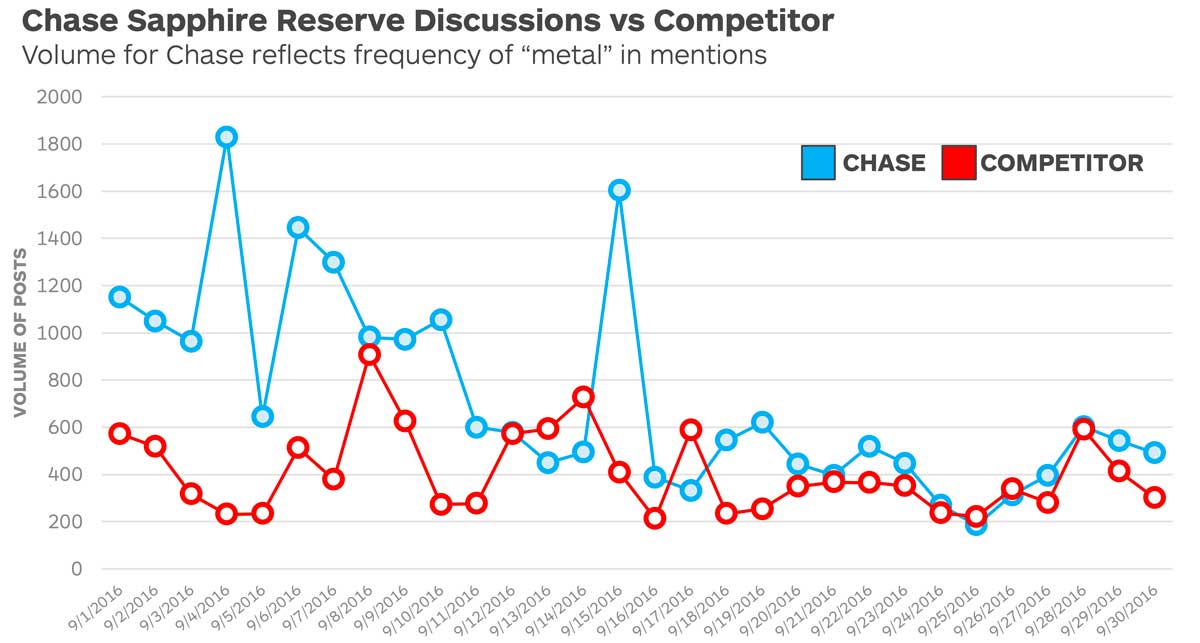

Spin the clock back two years to August of 2016. Chase rolled out their Sapphire Reserve card with a rarely heard of 100,000-point signup bonus inside Chase’s Ultimate Rewards program, with travel perks and credits that sent the millennial demographic into a viral online frenzy. To put the cherry on top, the card was released in metal form to mimic the air of prestige often associated with wealthy and elite cards. The result was a wave of new acquisitions our market intelligence was picking up on back in September of 2016 (See Figure 1), and were able to report out to our clients in the Financial Services arena. (Several of whom promptly converted portions of their card line to metal.)

Figure 1: Market Intelligence reporting in 2016 on Chase digital discussions

Since that time, pundits and financial bloggers have written extensively that Chase’s lucrative rewards for Sapphire customers cannot have been sustainable for the company. Indeed, Chase has reported losses on the 100K bonus offering and has taken steps since then to scale back the number of signups allowed. Then, this summer they rolled back so many benefits that cardholders began calling it the “summer of non-loyalty” and suggesting they might actually begin considering leaving the Sapphire brand altogether. Competitors began circling like vultures thinking this might be the final nail in the coffin and a means to acquiring the massive millennial demographic Chase has been in control of for some time.

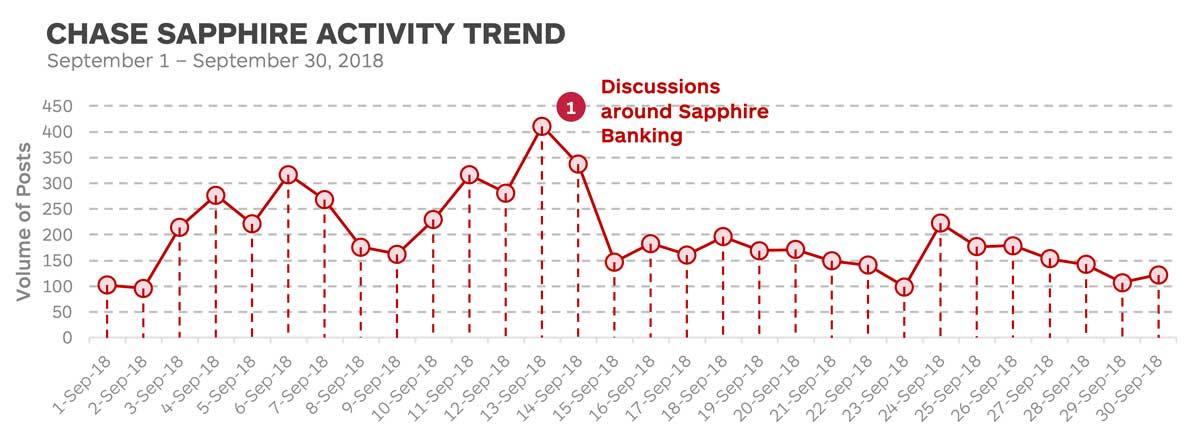

This past month, the volume shifted however, as our market intelligence teams began noticing volume trends around the Sapphire brand not dissimilar to those back in 2016. Conversations about Sapphire regaining the “halo-effect” were noticeable.

Figure 2: Sapphire Banking discussions last month

What our market intelligence indicated—and which Chase has since talked to—is a strategic play to first acquire a given target base and then work to develop them into both lifelong and higher value customers. Three key factors should be seen in their strategy:

- Initial acquisition costs may be significant – Not unlike Amazon’s strategy in the Kindle days, or their Prime rollout, Chase understood that initial lucrative offers might not turn an immediate financial return, but they will return a massive onboarding of clients. The initial 100K signup bonus with a slate of other massive perks was not sustainable, but it achieved its goal in driving millions of millennials into Chase’s brand.

- Evaluate the trade-offs today for the rewards later – Chase’s long-term strategy isn’t simply the two years from 2016 to 2018. Their vision is even further down the road – more than simply having millennials open checking accounts with Chase. Indeed, according to Chase’s own commentary, the offering of VIP access to concerts and early ticket sales in Sapphire Banking offers TODAY is intended to yield customers who will want wealth investment and lending services of larger sizes in years to come.

- Think “ecosystem” as opposed to simple “cross-selling” – Similar to Apple’s strategy to supply your phone, watch, laptop and tablet need on a common operating system… Chase is combining their card, banking and soon to be redesigned digital platform into an ecosystem where Chase’s goal is to own the entirety of the customer’s financial services needs and not simply be their preferred card provider. And the result is paying off. Chase is reporting at current a 75% active payments user rate, 48 million cardholder base, more than 50% of Zelle transactions, greater than 70% mobile wallet integration and a 22% credit card market share.

Chase is clearly taking the “long view” of cross-selling. We’re continuing to watch Chase closely as they redesign the customer financial experience with a long-term, cross-platform Chase brand experience.

For more on cross-sell, read our series on “How to Cross-Sell at Scale” Part 1 and Part 2