How Microsoft Just Added Fuel to its LinkedIn Fire to Take Down Salesforce.com

It may be too late to declare “let the battle begin!” between Microsoft and Salesforce.com to own the hearts and minds of sellers and marketers across the globe, but the rivalry may have just quietly entered a new and epic Clash of the Titans phase.

What Microsoft Just Did

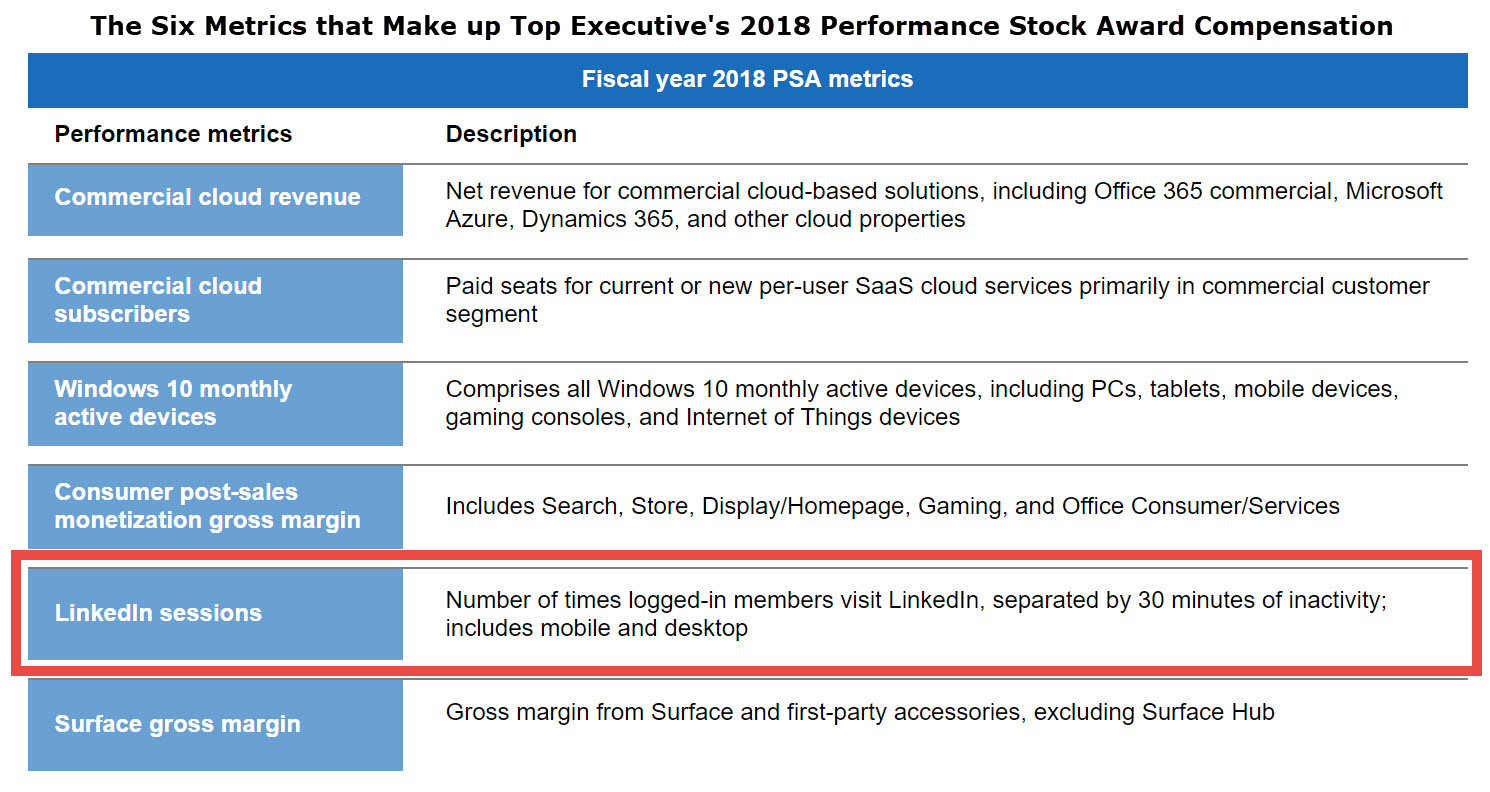

Last month, Microsoft unveiled a critical change to the performance-based compensation plan of CEO Satya Nadella and 4 other key executives – the only change to Performance Stock Award measurement compared to the 2017 comp plan. That’s significant.

And no one is likely to pay the price for LinkedIn engagement growth quite like Salesforce.com.

Outmaneuvering Salesforce.com

The essential difference between Salesforce.com and LinkedIn is simple:

Salesforce.com was built as a workflow platform with little embedded proprietary data; LinkedIn was built as a powerful database network light on (until now) workflow features.

While Salesforce has improved its proposition through the expansion of the Lightning platform and a robust AppExchange (as of May 2018, the marketplace hosted more than 3,400 apps with total app installs exceeding 5.6 million),

When Microsoft bought LinkedIn for $26.2B in June 2016, the staggering price raised eyebrows on how Microsoft would deliver a return on that investment and weave together the world’s largest professional social-media platform into core Office, Dynamics, and Azure cloud solutions. Over the past 2+ years, Microsoft has quietly been engineering massive data disruption opportunities for savvy Sales & Marketing teams.

To be clear, LinkedIn is not the robust CRM+ platform that Salesforce.com has developed. On its own, LinkedIn has real limitations to the long-term threat it may pose to Salesforce.com. However, when combined with Office, Dynamics, and Azure cloud platforms, it can become the secret sauce to seamlessly integrate how sales and marketing teams source, refresh, manage, utilize, share and report on data related to all things customer. Salesforce.com just can’t compare to that killer stack.

And the adoption and usage numbers are proving that out. Below are 3 reasons why LinkedIn’s current stature and future potential could permanently dislodge Salesforce.com as the platform of choice for Sales and Marketing execs:

#1 – LinkedIn is the most robust B2B database ever…period.

- LinkedIn is now 575 million users strong

- 260 million LinkedIn users are logging in each month

- 40% of monthly active users use LinkedIn daily (that’s 100 million+ members)

- 61 million LinkedIn users are senior level influencers, and 40 million of them are in decision-making positions

- 87 million Millennials globally are on LinkedIn

- 70% of LinkedIn users are from outside of U.S. (where many untapped buyers sit)

- …and LinkedIn’s reported goal is 3 billion users, which is 5X the current base

#2 – LinkedIn is a content distribution machine.

- 91% of marketing executives list LinkedIn as the top place to find quality content

- 94% of B2B marketers use LinkedIn as a content distribution channel

- There are 9 billion content impressions in the LinkedIn feed every week

- LinkedIn SlideShare now has 70 million monthly active users

- LinkedIn SlideShare also has 18 million pieces of content uploaded

- Yet, only 1 million users have published an article on LinkedIn (that’s only 0.2% having published an article using LinkedIn’s publisher platform) …the growth potential is huge

#3 – LinkedIn content (articles and posts) done right are conversion accelerators.

- 50% of all social traffic to B2B websites and blogs come from LinkedIn

- About 80 percent of B2B leads come from LinkedIn, 13 percent came from Twitter, and 7 percent from Facebook

- LinkedIn generates three times more conversions than Twitter and Facebook

- 65% of B2B companies have acquired a customer through LinkedIn

A Battle for the Screen of Choice

Changing executive comp plans alone doesn’t guarantee results and the Salesforce.com juggernaut will certainly have something to say about that. But Microsoft’s leadership team has consistently delivered outsized success in virtually all areas of cloud. Its investment in LinkedIn and now the intense focus on driving daily and intra-day engagement with the world’s largest B2B database and social platform may just be the key to one titan unseating another. 2019 may be a tipping point year for Microsoft to make LinkedIn the “screen of choice” for most sales reps and marketing professionals, not Salesforce.com.

Let the battle begin, indeed.