4-Step Approach to Cross-Selling into Mid-Market Accounts

In our recent CMO Survey blog post, we highlighted how Tech CMOs allocate three-quarters (74%) of their total marketing spend on their top priority: Driving growth from existing markets. This blog tells the story of HOW to get results driving cross-sell in those existing markets…using the experiences of a leading technology platform provider for digital and mobile payments as the hero of our story.

Want more detail? Download a PDF at the bottom of the page

Tech firms offering digital and cloud-based solutions (should) have great datasets! Not only tradition data on transaction frequency and spending levels but also IoT-related data on location, device type, and specific event triggers. With this high volume of customer, product, and transactional history the power of advanced marketing analytics offers a significant lift for cross-sell programs. This is particularly true in the SMB and mid-market customer segments, where accounts can number in the tens of thousands, coverage is broad through a network of resellers and partners, and account knowledge is diffused.

So how did one of our customers solve for this?

The Challenge:

Low sales rep productivity penetrating mid-market with a growing product line.

For this technology payments firm, their typical mid-market account manager was responsible for well over 100 accounts each and their ability to identify, prioritize and target cross-sell opportunities in their account portfolio was limited. Like most sales people, they knew their top accounts very well, but very quickly their account knowledge diminished as they went deeper into the portfolio (which is where much of the latent growth potential lies).

Meanwhile, Marketing would run monthly product-specific campaigns to mid-market prospects to source new leads for account managers. As a result, any single account manager’s ability to effectively, efficiently and consistently prioritize their outreach was limited. “Surfing” across the white space in their account roster while waiting for qualified marketing leads to be passed over was not delivering the required productivity. With new products being launched and competitive pressures rising, the company realized that they needed a data-driven approach to account coverage. This would maximize their cross-sell opportunity in the mid-market installed base while enabling sales and marketing productivity gains required to grow.

The Solution:

A 4-step approach to drive customer engagement and trigger qualified opportunities to sales.

We worked with our Tech client to deploy product propensity models enhanced with customer buying signals for each product across their portfolio. Scores were developed and updated weekly to supply prioritized opportunities to the account managers covering mid-market accounts. This approach was combined with continuous lead nurture campaigns based on product propensity—not an arbitrary outreach cadence—to drive engagement and trigger more qualified opportunities to sales.

Below are the 4 solution steps in more detail:

- Product Propensity Analytics: For each of the major product lines we developed product propensity models. These models evaluated the characteristics of clients who had previously adopted select products to identify the characteristics most predictive of product adoption. Had usage passed a certain threshold? Were there recurring service issues? Had revenue grown substantially? What other products in the portfolio were predictive of the need for additional products?This required gathering data from multiple different systems into a marketing data mart, including product usage data, service and support case files, firmographic information, contract data, and even credit data. These models were deployed to “score” underlying product propensity for a given product. This helped answer the question of what products should be offered.

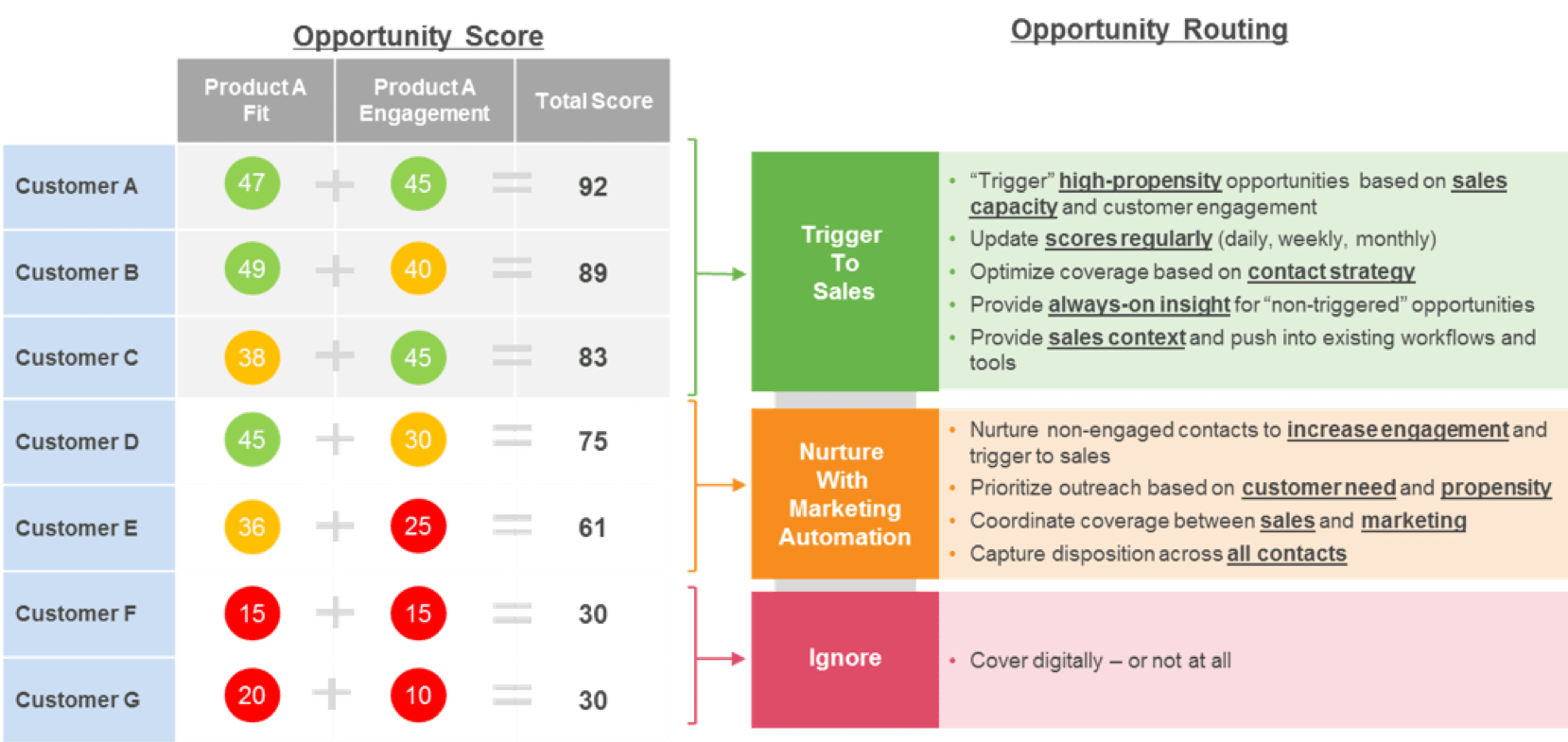

- Customer Engagement Insights: The propensity models were supplemented with customer engagement data to develop a hybrid product opportunity score that reflected both underlying product propensity (the what) – as well as current levels of customer engagement that were predictive of current need or intent (the when). Was the customer engaging with product information on the website? Did they respond to a campaign? Were they searching for a competitive solution online? By consolidating additional internal and external signals and updating scores on a regular basis, the models added a current engagement component to the underlying product propensity, providing a consolidated view of both the what and the when. The entire account portfolio was re-scored on a weekly basis for all unpenetrated products.

- Triggered Outreach: Each week, the top opportunities were “triggered” to the account managers and telesales reps. Using agreed-upon business rules including account assignment and product recommendation, the top 30 opportunities for each account manager were “flagged” within salesforce.com and assigned to the appropriate resource for outreach. Model scores and related insights were updated on the opportunity record so each account rep knew why that customer triggered for a specific product that week. Reason codes for model scores were displayed in plain English, providing context for the account manager as to why the recommended product was a good fit, and the recent engagement activities that were driving the current week’s trigger.These insights were key to driving adoption of the solution and provided the context that made the account manager much more effective in their outreach, as well as confident in the validity of the score.This solution leveraged current capabilities within Salesforce.com, and beyond the addition of several custom fields on existing objects, required no additional technology to implement.

- Lead Nurture Support: High propensity opportunities with low engagement that were not yet ready for sales outreach were placed into “always-on” nurture campaigns – as opposed to the previous monthly product-based cadence. These opportunities were fed into Eloqua for execution on a weekly basis as well. Once customer engagement surpassed a certain threshold, these opportunities would be triggered for sales outreach, based on the defined set of business rules. This solution aligned sales and marketing around prioritized needs across the portfolio vs. the monthly product campaign architecture that had been in place previously.

The graphic below illustrates the approach that was used to implement the solution.

The Result:

Cross-sell win rates improved by 34 points from 12% to 46% in the first 8 months.

When prioritized opportunities were “pushed” into Salesforce.com every Monday morning, sales performance improved almost immediately. After a brief pilot period with a handful of reps, the program was quickly scaled across the entire account management organization. In the first eight months, the win rate on cross-sell opportunities increased from 12% to 46%.

The account and opportunity intelligence from the predictive models that were provided in Salesforce.com were supplemented with targeted content and messaging for the specific product recommendation and the unique customer segment. This provided account managers with both the insights and the targeted content and messaging they needed – all on the same object within Salesforce.com. Similarly, this same segmentation was used to target all lead nurture messages through Eloqua, ensuring consistency across the entire buyer’s journey.

The realignment of marketing to support this data-driven approach to customer engagement was a significant enhancement to the previous calendar/product-based approach to campaigns. The result was a much tighter integration between marketing and sales, with marketing focused on nurturing customers over time to improve customer engagement around high propensity products. This end-to-end process also allowed marketing and sales to quickly dial up or dial down activity each week depending on changes in sales capacity, marketing priorities or other business requirements.