Customer-Centricity: Definition, Challenges, and Solutions

Like every business buzzword (or buzz-phrase, in this case), customer-centricity has lost a lot of its meaning as it has been adopted by marketers trying to differentiate their SaaS products. At the same time, it’s all there in the name, right? Being customer-centric means thinking like your customers, paying attention to your customers, listening to your customers, and designing your business for your customers. That all sounds great, and a little too common sense; of course companies should be customer-centric.

But, beneath this general feel-good mandate, there’s a lot more to unpack. In this article, I’ll walk through the history of customer-centricity, and how digital technology has ushered in a new era of customer-first marketing and support—at least potentially. I’ll then walk through some of the technological and people-related challenges companies typically face as they attempt to become truly customer-centric, and the solutions that we’ve seen work to get to real results.

If Customer Centricity Is So Important, Why Do So Many Businesses Struggle to Get It Right?

Customer centricity has never been more important to the success of both B2B and …

Read MoreThe Origins of Customer-Centricity

In the late 1990s, we wrote The Channel Advantage, a book focused on how to build world-class go-to-market operations. Our leading thesis was that companies that focus on go-to-market with the same energy as product innovation and quality outperformed product-only companies. This same logic has now been extended through the channel to the customer. Companies that focus radically on their customers outperform companies that stop at the retail storefront.

In many ways, this is nothing new. The 1960s were the golden age of market research applied to big advertising campaigns, as the social sciences caught up to business. Polling and focus groups were shown to be extremely valuable tools in creating compelling marketing. This science soon moved into retail, where shopper studies showed the best way to lay items out on a shelf, and how shoppers typically moved around the store. For creatives and retailers, market research was a mechanistic way to achieve some level of customer empathy.

For a relatively long period of time, the basic tools of customer-centricity—market research and subsequent management action on the recommendations—remained stable. However, in the 1980s, things started to change. The call center was in many ways the first digital channel. Humans were the APIs, but data was nonetheless codified and exchanged between company and customers, en masse. Instead of waiting weeks for a survey to come back, companies could instead get customer feedback in nearly real-time. Direct marketing companies, like Land’s End, Cabela’s, and AOL, were able to use data from the call center (or, in AOL’s case, the first log-on) to enhance mailings in a virtuous cycle that led to double-digit revenue growth. But, direct mailers coupled with call centers still faced a critical disadvantage—they only had a few minutes with each customer and had to rely on humans to enter data into a computer to understand their customers.

Digital Channels Eliminated Data Barriers to Customer-Centricity

With the advent of digital channels, data barriers finally dropped—or at least had the potential to drop—between companies and their customers. However, for a long time, companies focused on the transaction itself (e-commerce), making it slicker, faster, secure, and cheaper, which were all great things. But engineers tend to focus on bells and whistles and features, and while lip service might be paid to customer-centricity, the attitude was, for a long time, build it and they will come.

It’s only been in the past couple of years that digital channels have been seen as more than a low-cost, low friction transactional vehicle. Digital channels are now seen as sources of “data exhaust” that can be used to forensically build a true, always-on picture of customer behavior. This trend—which is enabled by many other buzzword megatrends like “IoT” and “Big Data”—is what has brought “customer-centricity” to the forefront in recent years.

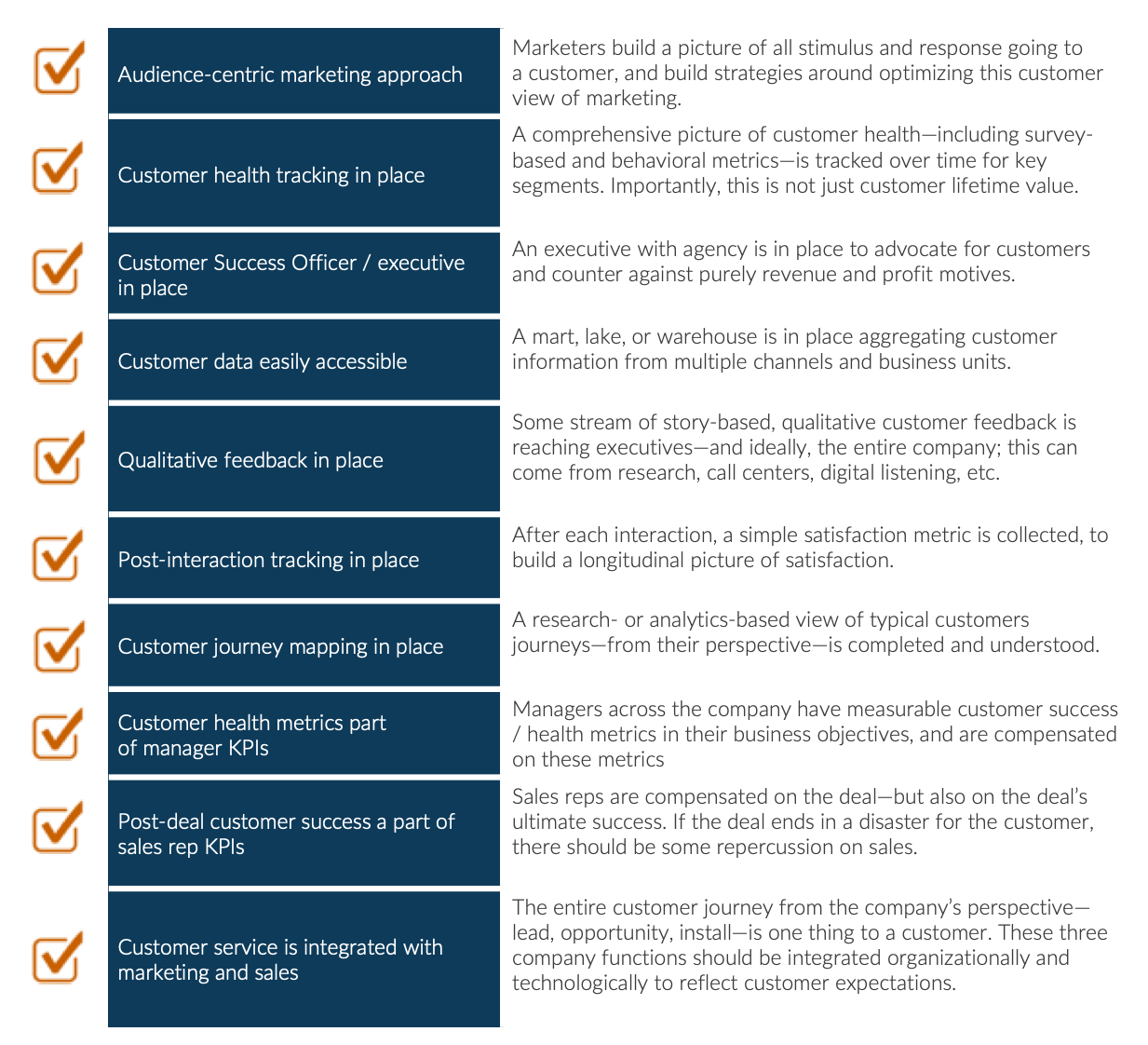

Checklist Definition of Customer-Centricity

Before I get into challenges and solutions, it’s helpful to provide a checklist/scorecard for customer-centricity. I have no scientific basis for this, but if an enterprise is reliably doing seven out of these ten things, they’re probably at least in the top 10% of customer-centric companies.

Five Challenges of (and Solutions for) Achieving Customer-Centricity

Hopefully, the checklist above provides a rough roadmap for executives looking to make the customer-centric journey. That being said, we’ve been down this road many times at MarketBridge, and you can expect many bumps in the road. There are definitely more than I’ve listed here, but these five challenges are ones that we see fairly often at MarketBridge. These can be broken down into two broad groups: data challenges and human challenges.

Data challenges are in some ways easier to fix; they can be defined in terms of discrete projects with defined goals. Human challenges are cultural, and take leadership, from the top down, to instill. Employees can tell if senior management isn’t really that interested in customer success (psst… just get the deal in the door, make the numbers, we’ll worry about the blowback later.)

1) DATA CHALLENGE: Relational databases are not the best tool for understanding customers.

Relational databases are the lingua franca of enterprise IT. Their structure has become such a given that many executives don’t bother to think whether they are the right tool to solve a given problem. And, they really are great; they are the basis for every enterprise software application in the world. But, they have a fatal flaw when it comes to customer-centricity—they don’t represent people very well.

Instead, relational databases represent customers as rows in a customer table, identified by an ID. That ID can then be strung together with attributes and interactions, but this join is in itself cumbersome and represents a significant roadblock to executives trying to understand a customer from their point of view. CRM, customer support, and marketing automation systems attempt to take this data and represent it in something more linear and integrated, but, even in 2019, fall down hard. It’s just not easy to represent a human being from their point of view, in a series of two-dimensional screens.

The Promise of the Marketing Data Platform

A relational data warehouse built with standardized schemas, loosely coupled to source systems, and …

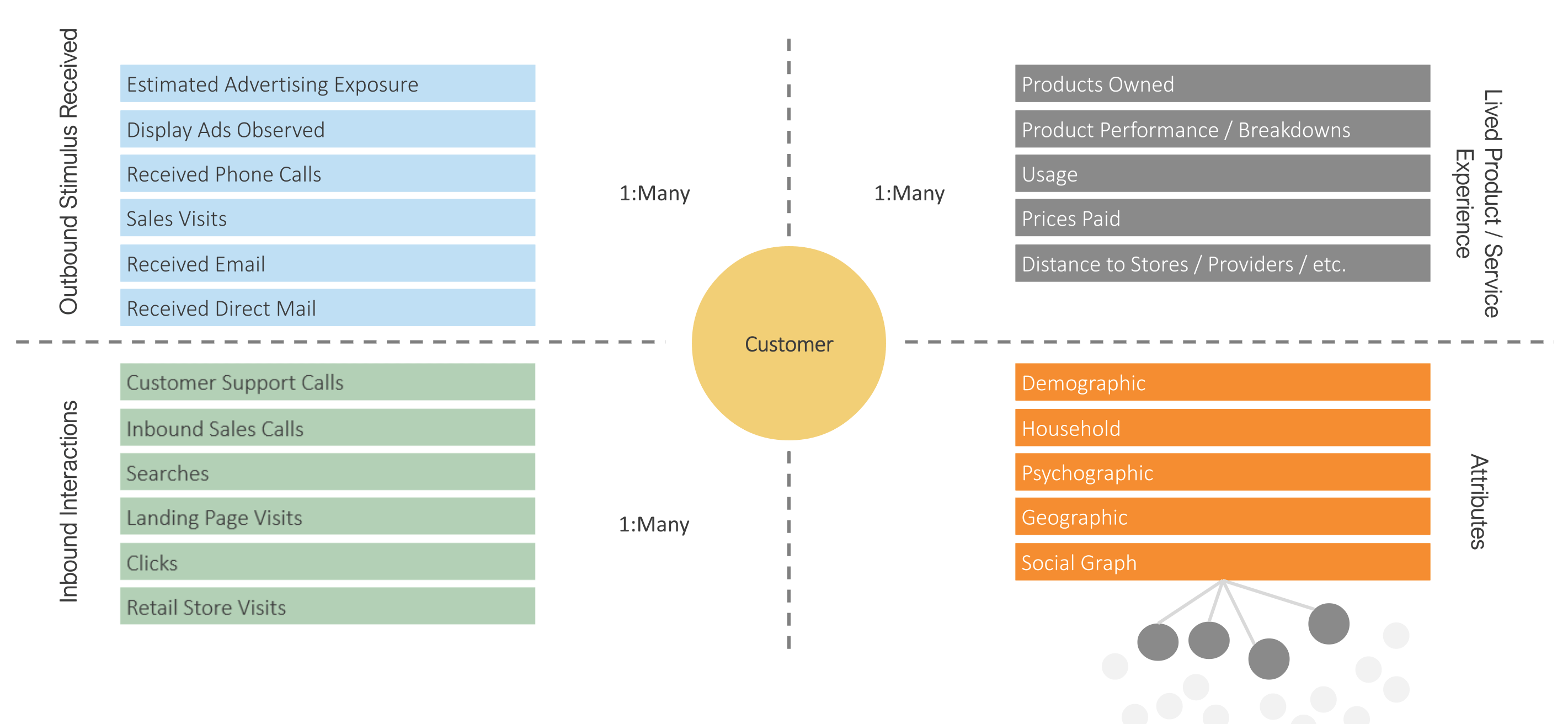

Read MoreSolution: The customer graph

Social graphs are one database answer to a person-centric view of the world. The concept of the social graph is remarkably simple; people are related to one another via many-to-many relationships, ad infinitum. Simple calculations can be made about how many 1st degree, 2nd degree, and Nth degree connections someone has. “Tribes” can be identified by shared connections.

A similar graph approach can be applied to marketing, sales, and customer service data. I call this the “customer graph.” Instead of relationships with people, the customer can be thought of as the nexus to all interactions with a company. This isn’t an uncommon structure for a customer data store; the challenge is that most companies are too limited in how they think of interactions. Interactions are not just, for example, interactions with a call center; they are retail store visits; sales rep visits; web searches; direct mail received and tossed in the trash; and so on.

Not all of these interactions are easy to obtain. Tracking retail store visits requires either some sort of geofencing app check-in capability or a purchase with a loyalty card or a tracked credit card. However, most companies don’t start with the logical data imperative of putting the customer at the center of everything, and thus don’t really try to get all of the data. Hence, we end up with siloing.

Figure 1: The Customer Graph

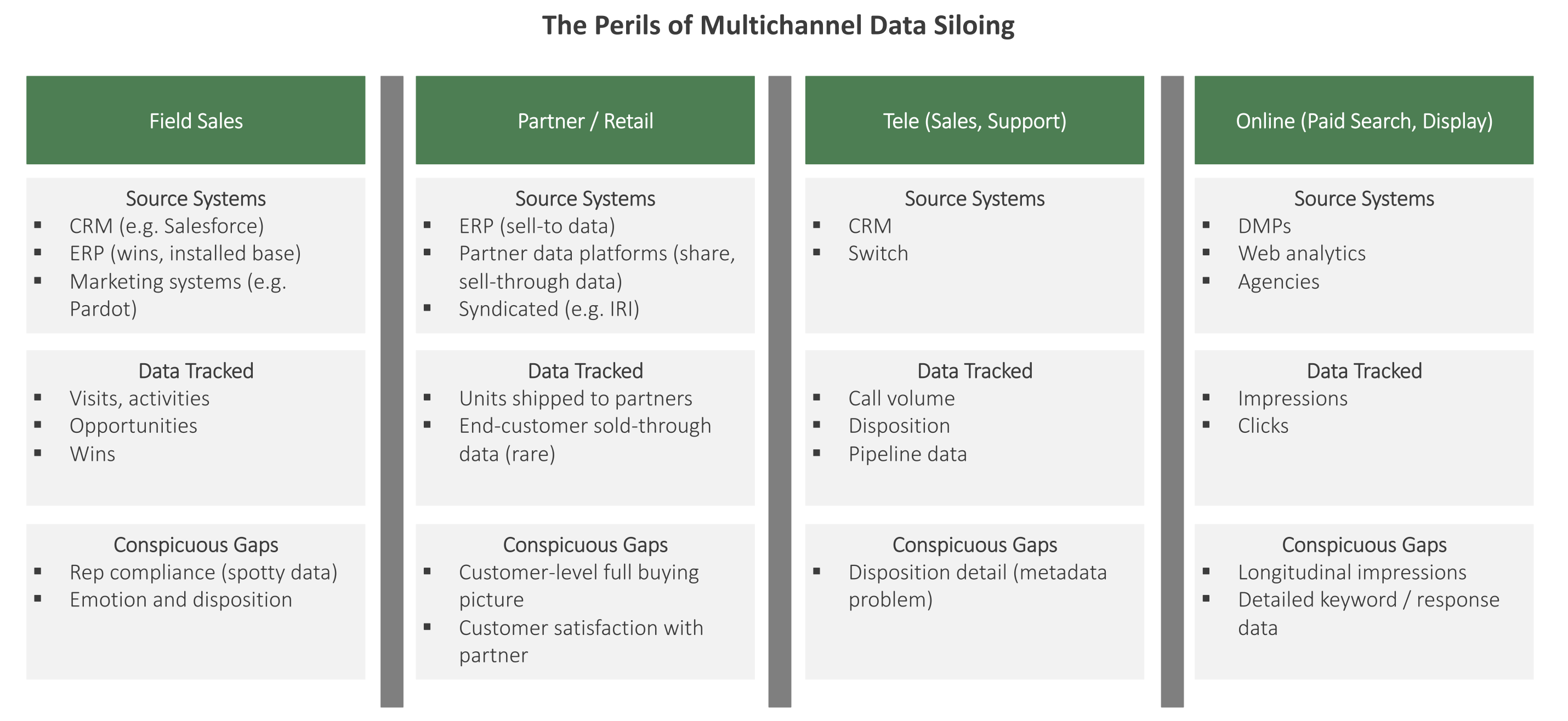

2) DATA CHALLENGE: Channels, applications, and data stores remain siloed.

For at least 20 years, executives have bemoaned siloed applications. Integrated systems are always a couple of years away on the roadmap—until that next “must-have” piece of enterprise software is acquired that does most, but not all, required business functions, and the cycle repeats itself. To a customer, moving from the customer support to the sales call center doesn’t mean anything—but in many companies, that customer literally disappears.

This same trend happens with channels. In tech, the retail channel looks fundamentally different than the value-added reseller channel when it comes to data. Different channels capture different kinds of data, and integrating them to create an omnichannel view of the customer is a challenge.

3 Strategies to Win with Customer Experience in the Platform-as-a-Channel Ecosystem

In a previous article, we discussed the rise of ‘platforms-as-a-channel’ and the implications for companies across …

Read MoreAll indirect channel data are challenging when it comes to customer-centricity. Channel partners are typically very reluctant to share their end-customer data. In some cases, they’ll share data, but with PII (personally identifiable information) removed. This makes it essentially impossible to build a single view of the customer.

Figure 2: The Perils of Multichannel Data Siloing

Solution: Cross-channel datastore

It’s unrealistic to think that one piece of enterprise software can be used to manage all channels. The alternative is a cross-channel data store. This is relatively simple if all channels are direct; it’s just the old enterprise data warehouse. However, if the company relies on indirect channels, it gets a lot more complicated.

Partners will share their data, but quid pro quos must be in place, and data security must be a priority. Quid pro quos can include benchmarking (where do you stack up vs. other partners); shared analytical models (combining manufacturer and partner data for a more complete view of the customer), and, of course, marketing funds.

Trusted third parties are a solution to guarantee that neither party will “steal” the other’s data. This is actually a service that MarketBridge provides manufacturers and partners; we act as a “Switzerland”, ensuring that no proprietary PII is revealed to the manufacturer or between partners.

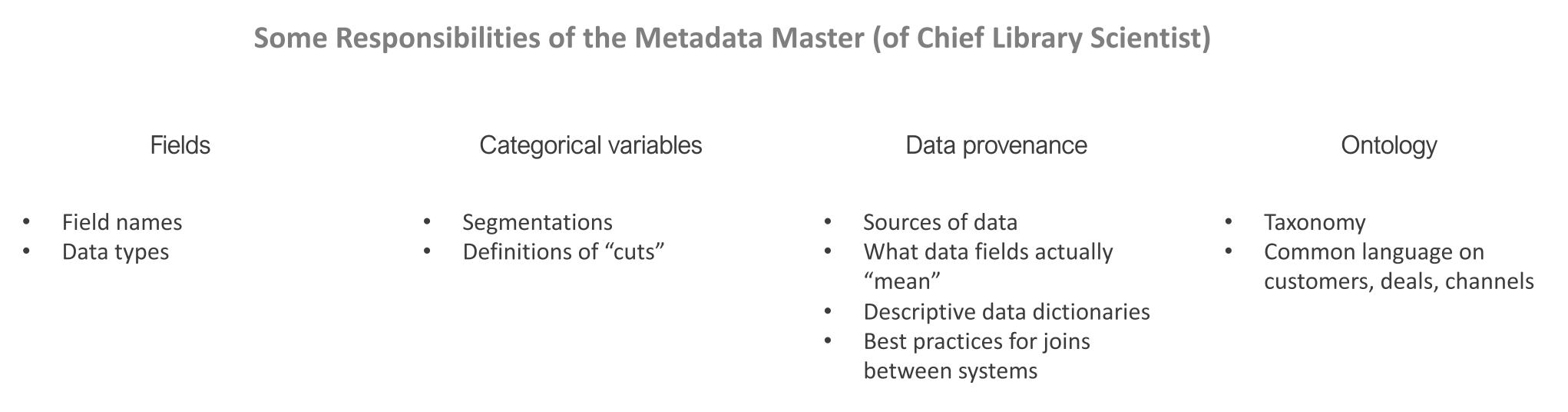

3) DATA CHALLENGE: Poor metadata.

Metadata are very unsexy. Nobody wants the job of being the “taxonomy master” at a company—but as every grade-schooler knows, librarians are very important. Disorganized data about data—for example, disposition codes at a call center, family structure codes, or company size levels—make customer-centric analysis next to impossible. Developing a common data language with categorical data is usually something that everyone wants to do but no one does do.

Solution: Formalize a corporate metadata management champion

The concept of a corporate, executive-level metadata manager—or, to be more blunt, a corporate library scientist—might sound zany. However, the benefits of an empowered executive who can enforce data terminology that aligns to a single view of the customer are huge.

One MarketBridge client estimated that over 500 hours were wasted per year in one department writing code to join between two systems where identical fields were represented differently. In some cases, fields had slightly different names, and in others, different data types. These were “small” issues that ended up dramatically interfering with the goal of creating a customer-centric data view.

Categorical data—the “buckets” or “cuts” used to divide data up into interpretable groupings—are another prime target for the corporate metadata executive. This typically creeps up in segmentation schemes. Demographic or firmographic segmentation doesn’t have to be complex. In fact, we’ve found that actionable segmentations that rely mainly on demographic rules yield better marketing results than complex psychographic schemas. However, even these simple schemas can fall down if common definitions of “high income”, “small business”, or “rural” are not rigorously applied and understood across the company.

Figure 2: The Metadata Master, Job Description

What About Small Data? Part 1

Big data remains all the rage. After exploding onto the scene in roughly 2012, …

Read More4) HUMAN CHALLENGE: Company narcissism.

This isn’t really a phrase people use, but maybe it should be. It’s hard for employees of companies to think in terms of their customers. Think about it; we spend 40+ hours per week at work. Our company’s brand badges, taglines, and advertising suffuse us, by design. This leads many employees to struggle with thinking about what their customers are actually experiencing in interactions.

Solution: Customer immersion videos

Immersion with customers—“ethnography” in market research terms—is a hugely helpful exercise to drive customer empathy. The “high” that results for a few days in market with customers seem to last weeks; every time I go out in the field, I am inspired at work, thinking of the individuals that I met and the stories I heard. The problem is, ethnography is expensive, and it’s impossible to get thousands of employees out observing customers; they have work to do!

How Simply “Watching Your Buyers” Can Increase Retention Rates

One of our clients recently came to us with an issue that we immediately …

Read MoreOne solution is to create customer immersion videos from ethnography. In today’s ROI-crazed world, it can be hard to spend dollars on videos that don’t have “real return.” However, showing a fifteen-minute, curated video of customers at a town hall can have huge return, as employees across the company start putting real stories and faces to what would otherwise be anonymous lines in a database or numbers on a spreadsheet. Send a videographer along with your researcher, and budget a few weeks to create your “best of” highlight reel, focusing on the tensions observed, unmet needs, and opportunities for every employee to delight.

I wanted to post an example of this kind of video here. I couldn’t use videos I’d done in the past, because they were proprietary for clients. I did a few Google searches, and what I found was pretty bad. Maybe this is because all of the good ones are behind company firewalls, but I think it’s also because companies don’t make this a priority. Research ends up in PowerPoints and doesn’t really come alive for anyone outside the readout conference room, and this has to change. That being said, this is an OK example. At least you’ll get the general gist.

5) HUMAN CHALLENGE: Metrics Focus

Not all metrics are bad when it comes to a customer-centric approach. For example, net promoter score is a solid overall metric of customer satisfaction. But other metrics can hide what’s truly going on beneath the surface. Response rate might be seen as a universally positive customer metric—but what about those customers who are clicking or calling to unsubscribe?

A myopic focus on financial metrics is another problem for customer-centricity. Profitability and revenue growth are great for shareholders, but neutral at best when it comes to customers. Cable companies are a great example; they manage based on number of customers and revenue per customer, with customer satisfaction taking a huge backseat. They have been able to do this because they have operated in near-monopoly conditions for 50 years. However, this profit-above-all-else mentality is now hurting, as customers aggressively piece together inconvenient and sometimes more expensive cord-cutting solutions just to get away from them.

Solution: Customer scorecards/dashboards

In sales and marketing organizations, dashboards are very popular. They typically show trends in top-of-funnel performance, conversion, sales, profitability, and cross-sell. What is conspicuously missing is information about customer health. In customer support organizations, the problem can be almost as bad. Call center hold times and satisfactory resolutions are certainly indicators of customer health, but a holistic view of customer health by segment, for example, is usually not available.

At MarketBridge, we’ve helped several clients turn dashboards and scorecards on their head, and focus on “pseudo customer’s” health. It’s not possible to display millions of customers and their individual health, but it is possible to show the typical, median customer—and then display customers one standard deviation below this customer’s health and one standard deviation above.

The typical customer, for example, might have a total health score of a B+. This B+ would be composed of scores for affinity to the brand (A-), engagement with direct marketing (B-), positive word-of-mouth (C+), and product satisfaction (A). The individual elements of the dashboard will vary based on the company and what it sells, but the basic idea is measuring this median customers’ health across all of the dimensions.

For the one standard deviation left and right customers, calculate standard deviation using the total health/amalgam score, and then show how the components change. For example, the average “worse” customer might be a C+, but it’s really product satisfaction (D) that is dragging this customer down. For more precision, these calculations can be done for different segments within your customer base.

Conclusion: Radical empathy

Customer-centricity is really about radical empathy. For executives, it’s about training yourself, every day, to look past aggregated financial reports, and to think about the individuals that are handing over their hard-earned cash to purchase your services. For marketers, it’s turning the “campaign” and “tactic” on their heads, and instead of understanding and intuiting what the customer is actually seeing, clicking on, and going through whenever she interacts with you.

Becoming a customer-centric company will absolutely pay off financially—but it’s also nice to know that you are leading a company that is truly respected—even loved—by your customers.