AEP Digital Listening Bulletin #2

Kaiser Leading Star Ratings, Some Consumers Questioning if Medicare Advantage is Too Good to Be True as Ratings Improve, Costs Come Down and Benefits Expand

Welcome to the second installment of our Fall 2019 AEP Digital Listening Bulletin. In this bi-weekly bulletin, we take a look at the trends, conversations, and themes that we are seeing dominate the Annual Enrollment Period discussion over the last two weeks as carriers, brokers, agents and enrollees go through this annual process.

Not surprisingly, the rhetoric has heated up as consumers began to react to the multiple messages and plan options being received around Medicare Advantage across nearly all media channels as AEP shifts to full speed.

Stars Are Rising

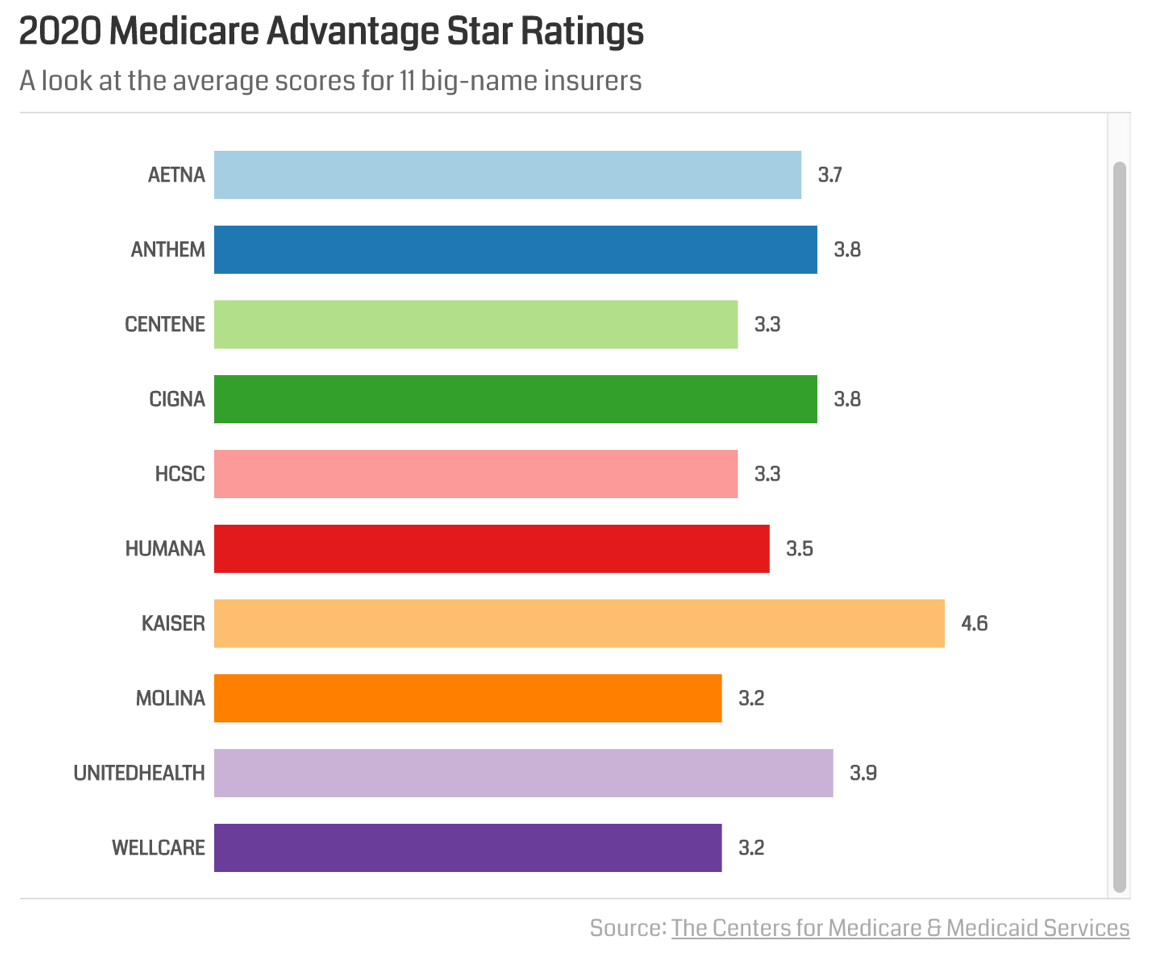

The “improved” CMS Star Rating system results were released on October 11 and show that Medicare Advantage and Part D plans remain a popular choice among beneficiaries and have higher satisfaction rates over 2019, as average Star Ratings continued to improve across the board. Kaiser is leading the pack.

KFF reports that the average Medicare beneficiary will have access to 28 plans in 2020, the highest number since 2010, with 3,148 plans available nationwide. Most plans will provide access to new features and benefits not covered by traditional Medicare—with premiums for 2020 expected to drop by 14% from 2019!

While the value proposition of increased benefits at lower costs is very compelling, health payers must be clear in their communications to consumers and in enablement of their agents and brokers about actual costs and plan differences as consumers go through the enrollment process to ensure customer satisfaction and persistency.

A lot of investment will go into that messaging this AEP. Last year, approximately 455 million direct marketing pieces were distributed in connection with AEP, an increase of nearly 30% over 2018. We estimate that well over 500 million pieces will be distributed this season to help spread the good word, as direct marketing continues to be a strong performing tactic with the Medicare population.

MA TV spots will likely exceed 300,000 this AEP as well, as health insurance marketers look to expand their coverage and optimize their cross-media acquisition and retention efforts.

Many of these messages are emphasizing the “Costs Less. Delivers More!” value proposition we referenced in our first Bulletin as payers—understandably—emphasize the lower costs, improved quality and additional benefits of many of the 2020 MA plans.

All That Glitters Is Not Gold

Almost sounds too good to be true! We are hearing even more discussion over the last two weeks that some of the MA ads are viewed as misleading or even deceptive by many consumers. Some examples:

- “I am listening to the Medicare Advantage Commercials. Free gym membership? Free dental? Really? These plans expect to turn a profit, so how can they give seniors more for less? By restricting physician choices, having a restrictive drug formulary, etc. @AAPSonline @HConomics” – @AlietaEck

- “Not a fan of commercials that emphasize shiny objects and gloss over the details that cause issues later. $0 premium? What about the deductibles? Not totally false but not 100% informative. It’s bait. The worse offenders R lead generating ads that sell your information.” – @SheronESidbury

Some consumers appear to be opting for Gap and Part D given these concerns over Medicare Advantage limitations on coverage and recent negative news about significant overcharges:

- “All my doctors told me not to go on an Advantage plan. Everyone I know in the medical field said never give up your original Medicare. So I went with original Medicare and plan F gap + part D drug ins. So glad I did. Two major surgeries later and I’ve never been billed for even a penny. No doctor copay, no nuthin.” -janellen

- “The consensus here is that these Advantage plans may not be the way to go. So now I am leaning way more toward the gap + plan D method. Wow. I’m glad I posted this question, and learned so much.” – mrkool

- “The great attraction of an Advantage plan to a senior is the very low or even zero cost. Seems like a no-brainer, right? Yet, in spite of that, many end up going with traditional Medicare plus a supplemental plan (“Medigap”). Advantage plans can limit or deny treatment or payment of claims. Just last year the New York Times reported, “Medicare Advantage Plans Found to Improperly Deny Many Claims.” NYT has a paywall, so I can’t post a link.” – fluffythewondercat

Brokers appear to be benefitting from all of this marketing activity and choice, as consumers seek out trusted advisors in the face of voluminous marketing claims:

- “I’m actually finding the commercials helpful. I work a lot of sales events, conduct educational events and am on the advisory board for my local council on aging, so I get a lot of referrals and am approached about things. People are looking for a real human to talk to face to face and question the commercials as “to good to be true,” because they talk about nothing but the good on the plans. I’ve written a bunch of med Supp whose rates had skyrocketed because they were asking questions that they wouldn’t have if not for the commercials. When I save them $100+/month on their Supp/PDP, I know they’re mine for life.” – StephanieCJ

The good news is that consumers are being presented with more choices this season to help manage their health care costs as they age.

It will be interesting to see the final tally of MA enrollments and the mix of plan types this season—especially with #Medicare for All as a constant backdrop: “A lot of ads on CNN past couple days for “Medicare Advantage”, attempting to convince seniors they already “qualify” for dental, vision and hearing care, to downplay the addition of full coverage by Bernie’s #MedicareForAll. They used to advertise some, but this is different.”-@leastimnotfugly

Reimagining Healthcare Through Technology

The October 21 announcement of a strategic, seven-year partnership between Microsoft and Humana to reimagine healthcare for more than 4M Humana aging boomer beneficiaries garnered significant attention as the latest in a series of important technology/healthcare partnerships designed to help transform the industry by leveraging technology and data to improve health outcomes, lower costs and simplify the heath care experience.

As a first step, Humana will “aggregate data on Microsoft Azure, enabling a truly longitudinal view of its members’ health histories…”. The next step is to “go beyond the collection of information to the delivery of insights. Microsoft technologies offer Humana the ability to apply sophisticated analytics to our members’ records and, in turn, provide clinicians and care teams with the opportunities to make a difference in patients’ health”.

Forbes views it as another important step in helping to develop a value-based approach to health care delivery. It does however sound very similar to the September 10 strategic partnership announcement between Google and the Mayo Clinic. “Google Cloud will secure and store Mayo Clinic’s data, while working with Mayo Clinic to apply AI and other cloud computing technologies to solve complex health care problems”. Followed quickly by Google’s announcement that it was acquiring FitBit on November 1 in an effort to compete with Apple Watch and other wearables.

Expect to see more of the “[Big Cloud Provider] will secure and store [HealthCare Provider/Payer]’s data, while working with [HealthCare Provider/Payer] to apply AI to solve complex health care problems and simplify the customer health care experience” announcements as technology bets are placed and strategic teams are formed.

Some remain skeptical:

- “Google/Mayo, Pfizer/Oschner, Flatiron/Pfizer now Microsoft /Humana. Oh how the patient personal health information sustains these companies and those feeding at the data silos increase.” – @DermHAG.

We are encouraged by the other announcement Microsoft made on October 21: “Azure API for FHIR® moves to general availability”. A significant step forward in helping to break down the silos.