How to Navigate Sharp Changes in Consumer Behavior Using Data – Big and Small

The essential ways we live and work changed virtually overnight. It’s stunning really. Consumer behavior did something incredibly rare, it turned on a dime.

As a result, companies are monitoring and assessing what consumers are doing at heightened new levels. Big data is being sorted and analyzed at accelerated speeds – from transactional history to online searches to response patterns – to help construct new business cases, develop forecasts, and even build models for leadership teams trying to make critical decisions during this new normal.

However, big data alone isn’t enough. The current consumer environment is emotionally-charged and continuously evolving. Companies need to understand why consumers are taking (or not taking) action. That requires small data: understanding what is motivating a consumer; and why they are thinking and feeling a certain way. Small data is an essential input to helping your organization address what to do today while preparing for changes in consumer behavior tomorrow.

Integrating big data and small data insights lead to top-line growth

Harnessing insights from big data and small data propels not only ongoing strategic initiatives but surfaces tangible go-dos that may “make or break” your customer experience during this critical time. That’s why customer research and analytics, should be an essential part of your Post Disruption checklist.

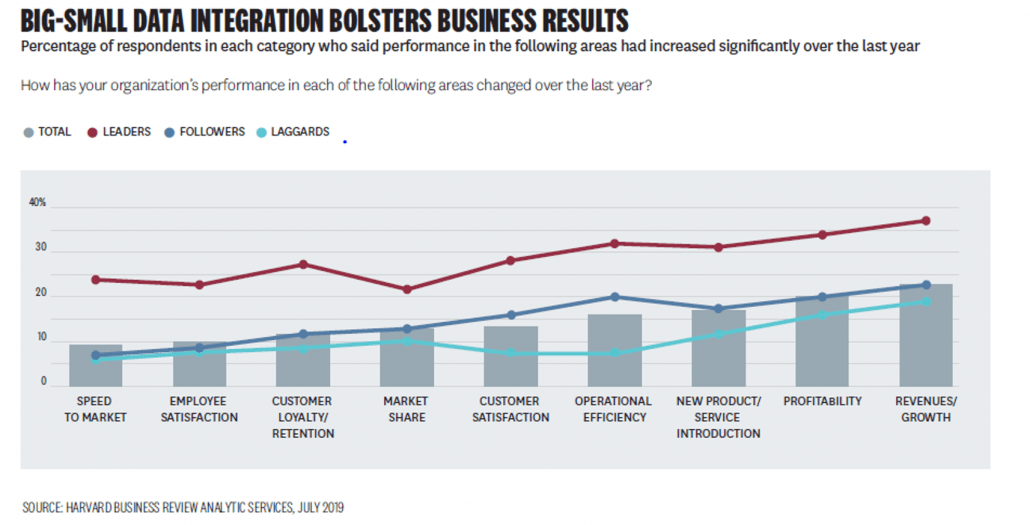

To be candid, this integration wasn’t easy to pull off before COVID-19, so you may need some help getting it done. Last July, a Harvard Business Review (HBR) study found that

“despite access to more customer data than at any point in history, only 23% of respondents believe their organization understands why their customers act the way they do.”

Only 23%. What’s roadblocking the other 77%? Reported reasons range from disparate technologies and data sources (which often leads to a lack of data standardization), to siloed teams responsible for quantitative versus qualitative analysis (which leads to a lack of knowledge-sharing/coordinated focus), to de-prioritization due to limited resources (which results in a lack of capacity to make it happen).

However, those organizations able to maneuver such roadblocks reap the rewards of enhanced top-line performance. HBR’s study found that organizations leading big data and small data integrations reported revenue growth that significantly outpaced the laggards.

Accelerate your insights to remain competitive and relevant

In today’s environment, continue to mine your big data – transactional data, online behaviors, response patterns, etc. And more importantly, use that data to develop hypotheses as to why consumers are taking those actions.

Next, use small data – in-depth interviews, survey data, focus groups, to validate or disapprove your hypotheses. And do it swiftly. This is not a time for lengthy research studies. Behaviors and attitudes are moving quickly and you need to keep pace or risk falling behind and becoming irrelevant.

Tap into the resources you have for quick-hit insights. Your customer service team is at the front lines and can provide directional sound bites from customers to help keep a pulse on sentiment. Digital listening is another way to keep an ear to the ground by observing customer conversations on social media channels and websites.

Reboot Your Buyer Experience: Aligning to Your Customers’ New Journey

Join us on Wednesday, May 13th at 3:00 PM ET as we cover what’s needed to deliver exceptional buying experiences in this new reality. Learn how to map new buyer journeys and use customer analytics to activate new, required selling motions ultimately delivering your most compelling message at the right time to the right buyer.

And of course, don’t rule out hiring the ongoing help you need to keep pace with your customers, the marketplace, or the competition.

No one knows the degree to which today’s new normal will continue, or if consumer behavior will turn on a dime once again. Harness ongoing big data and small data insights to prepare for what’s ahead.