Local Location-Based Commerce is Far, Far Larger than E-commerce

The modern miracle of e-commerce is entering its third decade. While there is some nitpicking, the consensus reported in the New York Times is that the first purchase on a commercial website was the purchase of a music CD on August 10, 1994.

Fast forwarding to this year, internet spending surpassed $300 billion for the first time, according to the National Retail Federation. Yet even with the awesome rise of e-commerce, offline retail sales volume is still more than 93% of US commerce. In a truly insightful analysis, Mike Ghaffary, a vice president at Yelp!, examined why some business categories will never go principally online and will remain local. Using a simple calculation he assigned a “local coefficient” to business categories based on three important factors on a scale of 1-5:

“Trying, meaning touching or seeing the product or service immediately before buying it; experiencing the service or product in person after buying; and substitutes, meaning whether or not a substitute is available online from a reliable source.”

Ghaffary’s resulting equation–L=(e+t–s+5)/15—produced a local coefficient he assigned to retail categories.

Today, location-based commerce is about thirteen times the size of e-commerce.

Ghaffary’s reasonable summary was that future brick-and-mortar commerce at any foreseeable theoretical equilibrium will be at least triple the size of e-commerce, adding it’s “hard to build a mathematical case that e-commerce will surpass local by the end of the decade.”

For the banking or asset management industry, location-based commerce is still important in building trust. For banking, when you open a co-checking account to provide some spending money for your kid going off to college, or open a savings account when you know a child is on the way, your local bank is your go-to source for a frank, honest face-to-face conversation. The way Ghaffary described “trying, meaning touching or selling the product or service” translates in a different way with banking and credit – talking directly with an employee, and much of the time consumers would prefer not to do it over the phone.

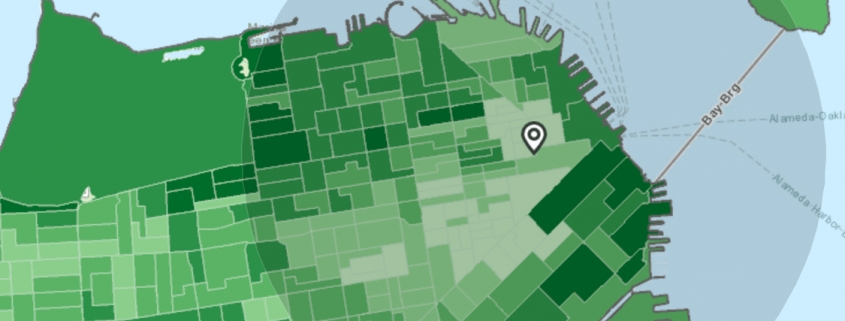

So if location-based commerce is growing, how do you, as a large corporation, measure as small as the local branch or advisor office? Things like:

- How is a given store performing?

- What actions make sense given the unique communities digital and social presence?

- Why is a store successful or not?

Data holds the secret, but most of the time, data is hard to understand or your system is too complex. By pulling together all inputs – your customer, your product, public information, firmographics, demographics … you can build analytics to determine the percentage of customers in relation to the size of the area and then deliver campaigns to increase performance.